A flexible budget will help you avoid overspending. One method we at Money Under 30 recommend is a 50/20/30 split regarding your net income. Each month, look at your spending and goals, Reevaluate and adjust where you assign your discretionary spending. You don’t need to be a Mathematics major, but percentages surely help. Give every dollar a job, based on your goals and what you discovered when you tracked your spending. It should also include things like groceries, entertainment, gas, or surprise expenses. These can include your goals, such as debt payment or savings. The amount of income you have left is what you can spend on discretionary expenses. If you are paying off debt, such as student loans or a credit card bill, find the minimum payment for each debt. These are expenses you must pay each month, such as rent, insurance premiums, taxes, childcare, or your cell phone bill. Pick the most pressing goals, such as paying off debt or creating an emergency fund, first.

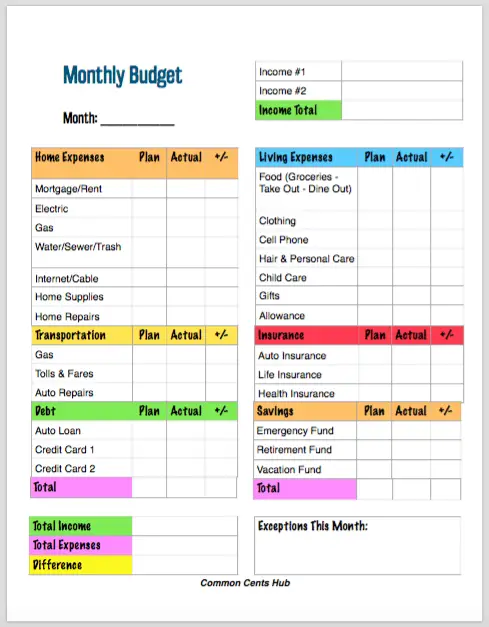

Remember, you can adjust these over time. Do you want to save money? Pay off debt? Stop overspending? Decide on realistic goals. Yarilet Perez We know that the earlier you learn the basics of how money works, the more confident and successful you’ll be with your finances later in life. Be sure to include automatic payments, subscriptions, and utilities. Spend a month keeping track of everything you spend, whether you pay with a credit card or cash, to find what your real expenses are. Personal budgets can be planned and managed as simply or extensively as youd like: with plain old pen and paper, a set of envelopes and your checkbook ledger, or elaborate. This should include all sources, such as a paycheck, tips, Social Security, disability, alimony, or investment income. A personal budget can be a powerful financial tool that helps you get out of debt, save money for emergencies, or work in a way to afford a monthly payment for a new car. Savings: Record the amount of money that you’re able to save each month, whether it’s in cash, cash deposited into a bank account, or money that you add to an investment account or retirement account like an IRA or 401(k) (if your employer offers one). Basically, a budget is a spending plan that maps out the amount of income versus the amount of expenses during a specific period of time.Discretionary spendingis nonessential spending or varying purchases for things like restaurant meals, shopping, clothes, and travel. For example, they might look at how much it costs to pay for someone to give a young person extra support at college or someone to help with speaking and communicating.

They include rent/mortgage payments, loan payments, and utilities. A Personal Budget is when the services that support a young person work out how much money they are spending on a young person’s support.

Their amounts don’t change (or change very little) and are considered essential. Fixed expensesare the purchases that you must make every month. Welcome to the Department of Defense Office of Financial Readiness website Look around, discover helpful tips and check back often for updates For the best. You can give legal control of your money to someone else, in case you become unable to. Review your bank statements, credit card statements, and brokerage account statements to be sure to capture them all. Budget and savings calculators can help keep your spending on track.

Income: List all sources of money that you receive in a month, with the dollar amount. So here are some of the best types of personal budget you can try: 50/30/20 Rule Budget. A 2013 Gallup poll showed that only around one third of U.S.

0 kommentar(er)

0 kommentar(er)